This project is a minimal AMM (Automated Market Maker), inspired by Uniswap V2. It supports adding liquidity, quoting prices, and swapping ETH ↔ Token.

Deploy address https://sepolia.etherscan.io/address/0x4e6037b6613dba5aba761e3b14c7954f114947b7

src/UniswapV2.sol: Main contract implementing the AMM logiclib/openzeppelin-contracts/: ERC20 standard contract dependencytest/: Test scripts and casesscript/: Deployment scripts

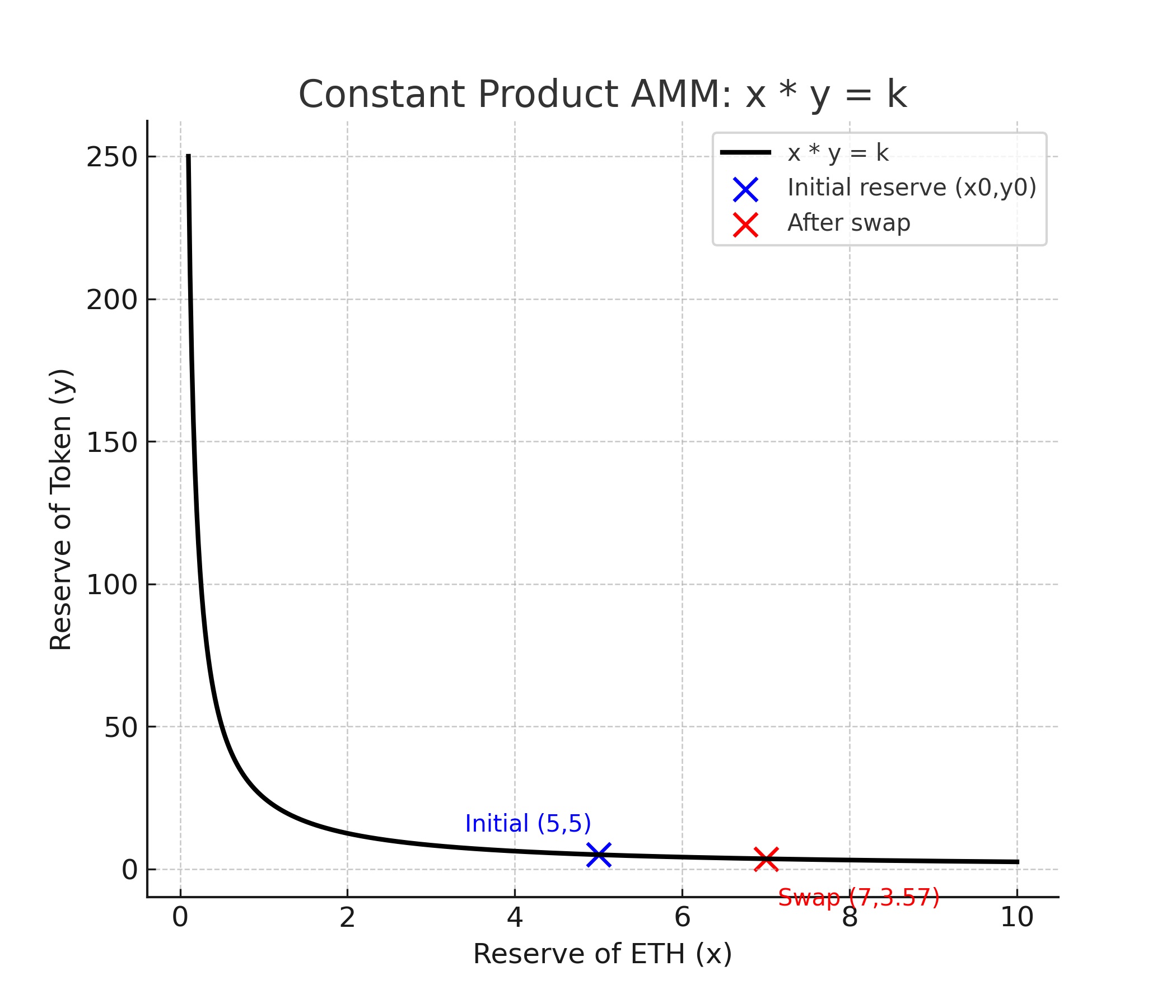

Core invariant:

x * y = k

x= ETH reservey= Token reservek= Constant (liquidity invariant)

IERC20 public immutable token;

uint256 public reserveEth;

uint256 public reserveToken;token: ERC20 token contractreserveEth: ETH liquidity storedreserveToken: Token liquidity stored

👉 These reserves are always synced with the actual contract balances.

function addLiquidity(uint256 tokenAmount) external payable- User sends ETH + Tokens

- Both are deposited into the pool

- Internal reserves are updated via

_sync()

📌 Check: Zero liquidity is rejected.

function quote(uint256 amountIn, bool ethToToken)Formula (with 0.3% fee):

amountOut = (amountIn * 997 * reserveOut)

/ (reserveIn * 1000 + amountIn * 997)

- Preserves

x * y = k - Larger trades = higher slippage

function swapEthForToken() external payableSteps:

- User sends ETH (

msg.value) - Contract calculates

tokenOut = quote(ethIn, true) - Transfer Tokens to user

- Sync reserves

function swapTokenForEth(uint256 tokenIn) externalSteps:

- User sends Tokens via

transferFrom - Contract calculates ETH out using

quote - Contract sends ETH (

.call{value: ethOut}) - Sync reserves

The constant product formula produces a hyperbolic curve:

- Adding ETH decreases available Token (and vice versa)

- Prevents draining the pool completely

- Defines price slippage

Covered cases:

- ✅ Add liquidity success & revert on zero input

- ✅ Quote matches Uniswap V2 formula

- ✅ Swap ETH→Token & Token→ETH

- ✅ Reverts on insufficient liquidity

Run tests:

forge test -vvDeploy on Sepolia testnet:

forge script script/Deploy.s.sol:DeployExchange \

--rpc-url $SEPOLIA_RPC \

--broadcast- Simple AMM = no order book, only liquidity pool

- Core invariant = x * y = k

- Prices adjust automatically → slippage is inevitable

- Liquidity providers earn fees from swaps